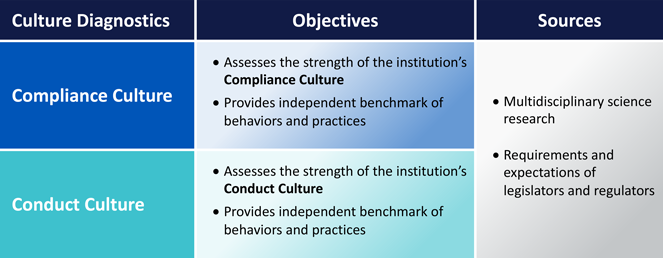

CULTURE DIAGNOSTICS

Our culture diagnostics are anonymized and independently administered survey tools that assess employee perceptions of the drivers that determine an organization’s compliance and conduct culture. We believe people’s behaviors are based on their perception of reality and the world around them which then shape expectations and behaviors.

Assessing the strength of the cultural drivers and using the results to strengthen these drivers is well-established in behavioral science research. It has formed the basis of successful change programs designed to improve outcomes across multiple domains. Our constructs of compliance and conduct culture refer to decision-making and behavior in the financial industry.

These are described in more detail below.

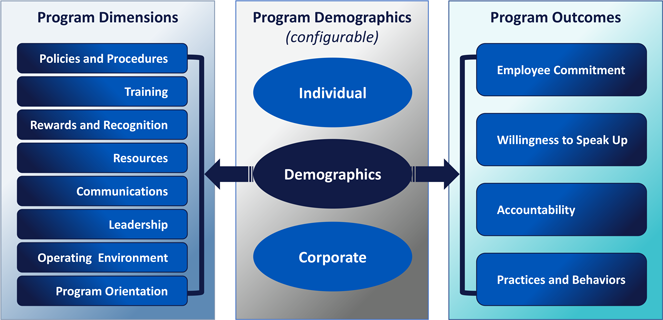

Compliance Culture Diagnostic

Our diagnostic is a perception-based assessment that measures the extent to which employees view the compliance culture of the institution as facilitating their compliance related decisions and behavior. It is derived from judicial imperatives, regulatory expectations and validated behavioral science studies. Our grounding concept is that a healthy compliance culture will be correlated with good compliance-related outcomes.

A 15-minute assessment is administered to all employees, designed to ensure that responses are entirely anonymous and independent of each other and tailored to the specific needs of the institution. Demographics can be segmented and evaluated by any desired breakdown, and multiple languages can be accommodated for international deployment.

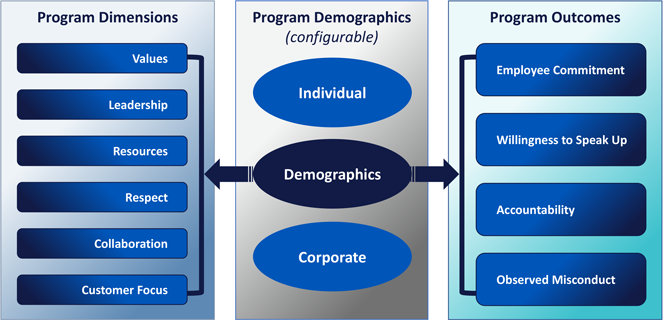

Conduct Culture Diagnostic

Our diagnostic is a perception-based assessment that measures employees’ views of how their work culture supports their decision making and behavior. It has been produced through a multidisciplinary approach, which marries industry knowledge with academic rigor. Guiding our approach is the idea that healthy (functional and strong) conduct culture will be correlated with reduced employee misconduct and business conduct risk.

A 15-minute assessment is administered to employees in a way consistent with respondent anonymity. The diagnostic can be tailored to the specific needs of the institution. Data is analyzed using statistical packages and methodologies agreed upon by expert behavioral scientists.

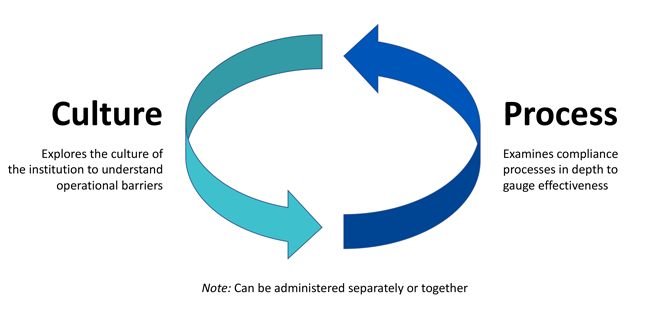

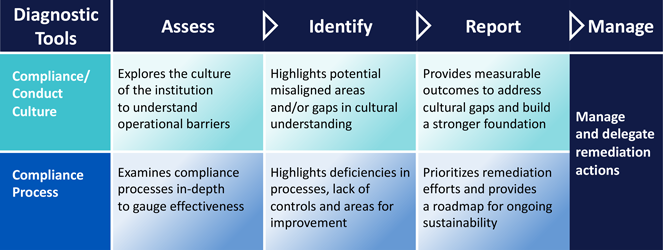

Convergence of Culture and Process

Our culture diagnostics may be combined with our process tools to manage areas of improvement or remediation actions. Our approach explores the culture of the institution to understand operational barriers as well as compliance processes in depth to gauge effectiveness and sustainability.

For more information on how culture and process converge, please contact us.

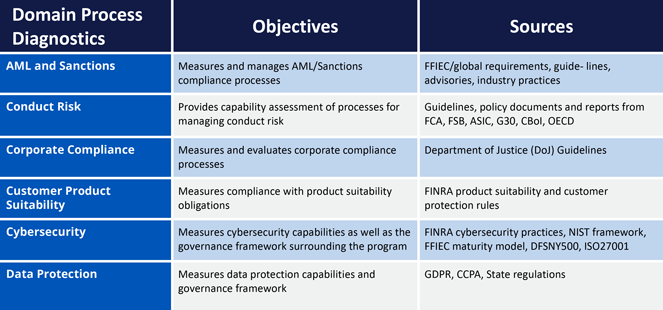

PROCESS DIAGNOSTICS

Our process diagnostics are designed to help you assess various regulatory and compliance programs. They are mapped to legislative obligations and related guidance, enabling you to evaluate the extent to which your compliance programs meet these expectations. The requirements and guidelines are identified and linked for cross-referencing to the underlying assessment questions. By clicking on relevant links, users can cross-check the actual legal requirement.

These are described in more detail below.

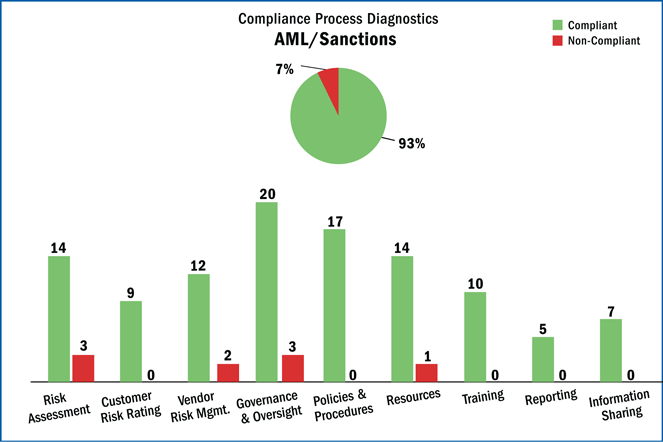

AML/Sanctions Process Diagnostic

Our compliance diagnostic for AML/Sanctions consists of an evaluation of the strength of 16 different processes across four domains. Based on applicable legislation, the diagnostic reflects guidance from regulators and authoritative international bodies and incorporates regulatory expectations around best practices. This diagnostic can be tailored to address the specific business profile and regulatory obligations of each institution.

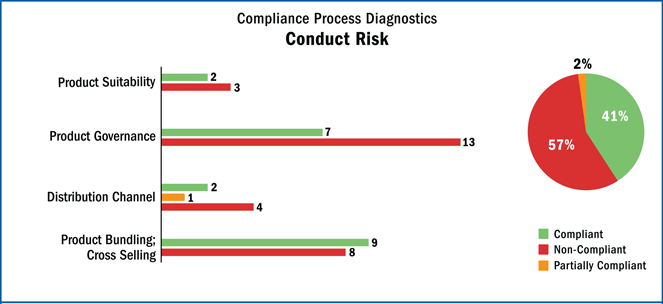

Conduct Risk Process Diagnostic

Our conduct risk process diagnostic provides capability assessment of conduct risk management. With 80+ questions overall, it has specific sections that address product governance and suitability for the retail market. The diagnostic is based on guidelines, policy documents and reports from Financial Conduct Authority (FCA), Financial Stability Board (FSB), Australian Securities and Investments Commission (ASIC), Group Thirty (G30), Central Bank of Ireland (CBoI), and Organization for Economic Cooperation & Development (OECD).

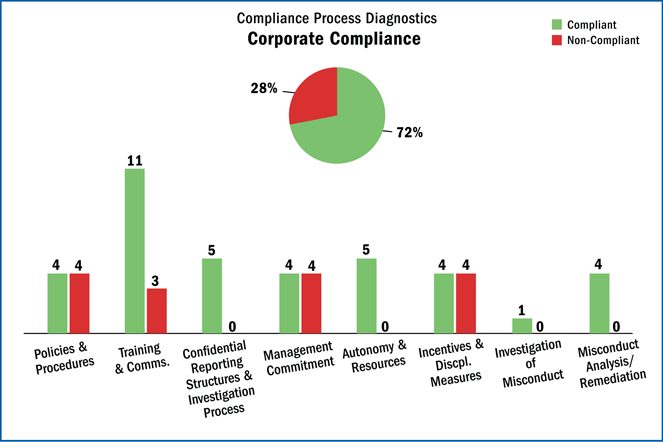

Corporate Compliance Process Diagnostic

This diagnostic evaluates the strength of a corporate compliance program. Based on DoJ regulations, the diagnostic reflects regulatory expectations around best practices. This diagnostic can be tailored to address the specific business profile and regulatory obligations of each institution.

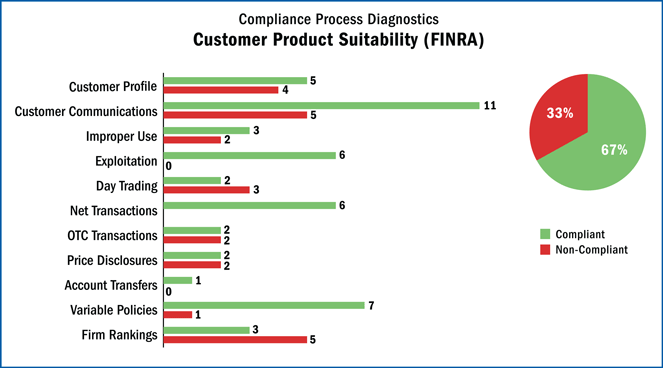

Customer Product Suitability (FINRA)

This diagnostic evaluates the process in place to ensure customer protection and suitability requirements for broker-dealers. Structured directly from the FINRA Handbook, it ties the key rules into 44 sections (e.g., customer profile, improper use, identifying conflicts of interest) to ensure that all areas covered under FINRA are identified for evaluation purposes. These are designed to help the institution determine that the right processes are in place and are sufficiently comprehensive, appropriate and robust.

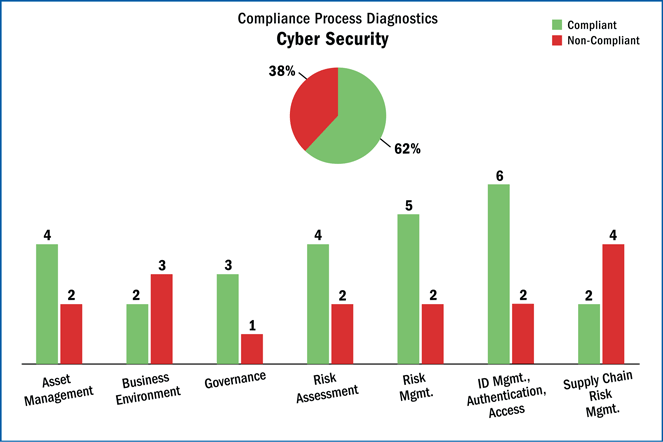

Cybersecurity

Our cybersecurity diagnostic tool supports assessment in the cyber domain in a targeted fashion. Given the high priority by regulators to cyber threats, this tool covers FFIEC regulations, NY DFS 500 and industry practices to assist in determining whether a client’s cyber security program is up-to-date to identify vulnerabilities or gaps and to pinpoint areas for remediation.

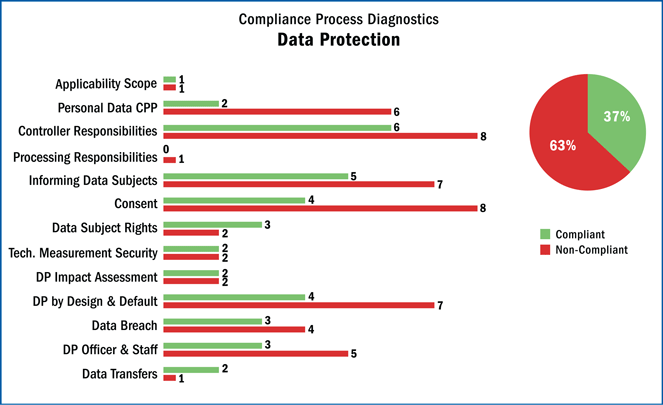

Data Protection

This diagnostic tool supports assessment in the data protection domain. Given the recent focus on protection of personal information and the passage of GDPR and CCPA, this tool has been developed to help determine whether a client’s approach to data is in compliance with GDPR and/or CCPA, depending on your institution’s needs.